Fueling Growth With Long-Term Financing For Business

If we set rules for a company’s growth, what would be that? I believe one should be opening new locations, building more factories, or buying new equipment. But if we look, we find that growth costs a lot of money that most companies don’t have sitting around. That’s why these businesses and companies take out long-term loans from banks or from any online app, such as personal loans. That’s the thing we’re discussing today.

We’ll check how businesses take advantage of long-term financing to fund expansion projects and capital expenditures, shedding light on industries or sectors where this financial strategy is prevalent.

What are long-term loans?

A long-term loan is money borrowed from a bank or financial institution that gets paid back over an extended time period, usually between 5-10 years or longer. Unlike short-term loans that get paid back in under a year, long-term loans allow companies to access larger amounts of financing with longer repayment schedules. Nowadays, companies can even apply for long-term loans conveniently through online platforms, known as online loan, streamlining the borrowing process and making it more accessible.

Industries Leveraging Long-Term Financing:

- Manufacturing:

Manufacturing businesses often require substantial capital for facility expansion, machinery upgrades, and the adoption of advanced manufacturing processes. Long-term loans play a pivotal role in supporting these capital-intensive ventures.

- Technology and Innovation:

Companies in the technology sector frequently use long-term loans to fund research and development, product launches, and the acquisition of cutting-edge technologies. These investments are crucial for staying competitive in the rapidly evolving tech landscape.

- Real Estate and Construction:

Real estate developers and construction firms heavily rely on long-term financing for large-scale projects. Whether it’s residential or commercial developments, the extended repayment period aligns with the extended timeline of such ventures. This long-term financing often takes the form of a credit loan, providing the necessary funds to support these projects over an extended period.

- Healthcare Infrastructure:

The healthcare industry often seeks long-term loans to finance the construction of new hospitals, clinics, and research facilities. This facilitates the expansion of healthcare services and the incorporation of advanced medical technologies.

- Renewable Energy:

The renewable energy sector requires substantial capital for infrastructure projects, such as solar or wind farms. Long-term loans support these initiatives, contributing to the development of sustainable energy solutions.

Benefits of Long-Term Financing for Businesses:

- Stability in Repayment:

Long-term loans, spanning over many years, provide businesses with the flexibility of low monthly installments. This predictable repayment structure enables financial planning over an extended timeline without worrying about lump-sum repayments straining liquidity. The continuity in loan servicing helps reinforce financial discipline.

- Facilitates Strategic Planning:

The injection of long-term capital, be it equity financing or long-term debt, provides a stable base for executing business strategies. With investor confidence and financing secured, strategic projects for market expansion, diversification, and innovation can be undertaken to enable growth in tune with long-term visions rather than short-term considerations.

- Enhanced Liquidity Management:

As long-term loans initially allow a considerable interest-only period, businesses can conserve cash flows in the years when scaling up operations is crucial. Access to capital ensures liquidity levels are maintained so that expenses integral for growth like R&D, recruitment, and marketing are sufficiently funded through operational cycles before repayment commitments arise. This enhances the continuity of business activities. Companies can also use long-term loans as a source of money loan, providing them with the necessary funds to support various aspects of their operations and expansion plans.

In closing:

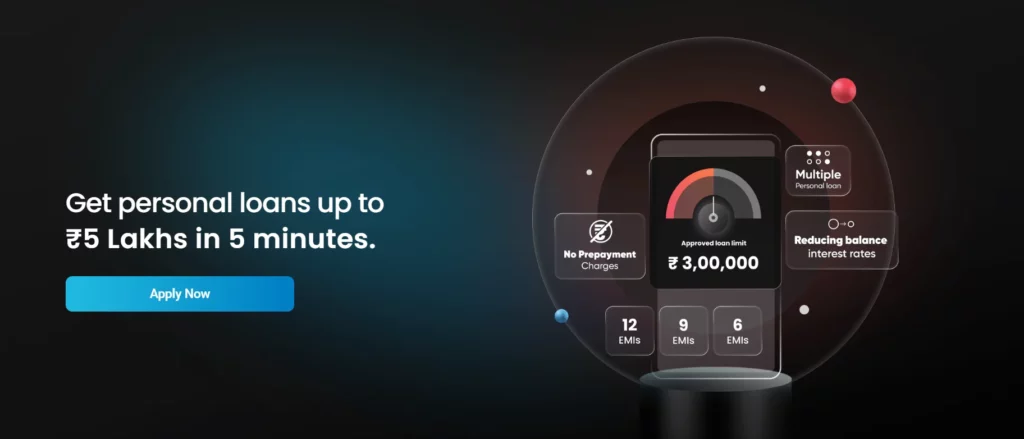

Long-term loans have emerged as a valuable financial tool in the domain of business expansion and capital expenditure, empowering companies to realize their growth aspirations. By understanding the strategic application of long-term financing and examining industries where it is prevalent, businesses can navigate the path to expansion with financial resilience and strategic foresight. The availability of convenient loan app India services has further streamlined the process of accessing long-term financing, enabling businesses to secure the necessary funds more efficiently.